Enjoy a first-of-its-kind reward — receive Tesla fractional shares when you insure your Tesla with ECICS.

This exclusive benefit is made possible through our partnership with Phillip Securities Pte Ltd, a trusted name in investments.

Get comprehensive protection for your electric vehicle — including roadside assistance, accident repairs, and windscreen claims.

Transfer your NCD from other insurers and enjoy peace of mind with our round-the-clock claims support.

Discount is automatically applied. Not stackable with other promos. Click here to see Terms and conditions

(if you don’t have one)

(if you don’t have one)

The premium is determined by the plan you choose, not by your age.

No. You’re eligible as long as you have a valid insurance policy issued by a Singapore-licensed insurer.

Yes, if you change your mind after the policy is issued, please write to us within 14 days from the date of receipt of the policy. We will refund you in full subject to no claims made under the policy.

We get it – plans can change. If you are replacing your FDW after purchasing the policy:a. Prior to policy effective date, you may provide us with the new FDW details. We will make the necessary changes on the policy replacement. The promo can be re-applied to the replacement policy but please note that the promo can only be re-applied on a replacement policy once if the original policy has not started. b. If the policy has started and you need to replace your FDW, you have 90 days from policy effective date to cancel and a further 90 days to issue a replacement policy. You will get 100% refund for the original policy but unfortunately, the promo cannot be re-applied to the replacement policy. If you no longer require an FDW, you may get a 100% refund if you cancel before the policy incepts. Please take note that all cancellation date shall be based on the security bond discharge date from MOM and not the work permit cancellation date.

The coverage period for our Tesla Motor Insurance is 12 months or 24 months subject to Break And Review Clause.

New and transfer maid policies purchased:• within 14 days before the effective date,MOM’s record will be updated within 3 working days after the policy purchase date• more than 14 days before effective date,MOM’s record will be updated within 14 days before policy start dateRenewal maid policy:• MOM’s record will be updated within 3 working days after the policy purchase date.Please check the MOM portal and ensure that the electronic transmission to MOM is completed before your FDW arrives in Singapore. Failure to do so will result in the Immigration and Checkpoints Authority denying her entry, and she will be sent back to her home country.

Refund Policy (Upon Policy Termination):0 to 30 days in force – 80% refund of premium31 to 90 days in force – 50% refund of premium91 to 180 days in force – 30% refund of premium181 days and beyond – No refund100% of the premium will be refunded if:a) The Policy is cancelled within 90 days from the policy effective date and replaced with a new ECICS Enhanced MaidAssure policy; orb) The In-Principal Approval (IPA) is terminated and the FDW did not enter Singapore.Provided there shall be no refund if: • Any claim has been made or has arisen under the Policy; or • The premium refund is less than $27.25 (inclusive of GST). Please refer to General Conditions point 19 of the policy wording for the full cancellation terms and conditions.

Yes, we offer it as an optional add-on that covers outpatient medical expenses for illness that does not require hospitalisation. This benefit can cover up to $60 per visit, helping to ensure your FDW’s health needs are taken care of without added financial strain.

Certain amendments (e.g., typo error in name or passport number or change in effective date) can be made before the policy effective date. However, a re-transmission to MOM may be required depending on the type of amendment.

Here's how you can determine the effective date based on each situation:For New FDW:The policy's effective date should be the date your FDW arrives in Singapore. This ensures that insurance coverage begins when the FDW starts her employment duties upon arrival in the country.For Transferred FDW:The policy's effective date should be the day you wish to apply for the issuance of her work permit at MOM. This ensures that insurance coverage is in place when the FDW's work permit is processed and approved for transfer to your employment.For Renewal FDW:The policy's effective date should be one day after the current work permit's expiry date. This ensures that insurance coverage seamlessly continues without any gaps when renewing the FDW's work permit for continued employment.

All riders need to be named in the policy. Unnamed riders are not covered.

Yes, it is illegal to use a vehicle in Singapore without a valid insurance cover. At a minimum, you must have third-party insurance, which covers injury or damage caused to other people and their property.

Yes, ECICS motorcycle insurance policy comes with complimentary No Claim Discount Protector. It is free for our customers as long as you have NCD 10% and above.

We have 3 plans to suit your needs. The Comprehensive plan covers loss or damage to your motorcycle, as well as third party liability for bodily injury and property damage.

We do not cover usage for food, parcel or other delivery services.

You will only need to report to the police under the following circumstances:Damage to Government vehicle or propertyAccident with a foreign registered vehicleA Hit and Run accidentVehicle is stolen or vandalisedVehicle caught fireAccident involving a Pedestrian, Cyclist or Personal Mobility Device (PMD) usersA Malaysian police report is required if the accident happened in Malaysia.

Please repair your windscreen at an ECICS Authorised Workshop. Call the workshop of your choice and they will help you file your claim and advise you accordingly. Click HERE for a copy of the Windscreen claim form.If the windscreen claim is of criminal or vandalism-related, a police report must be made. A copy of the police report must be submitted to your choice ECICS Authorised Workshop.

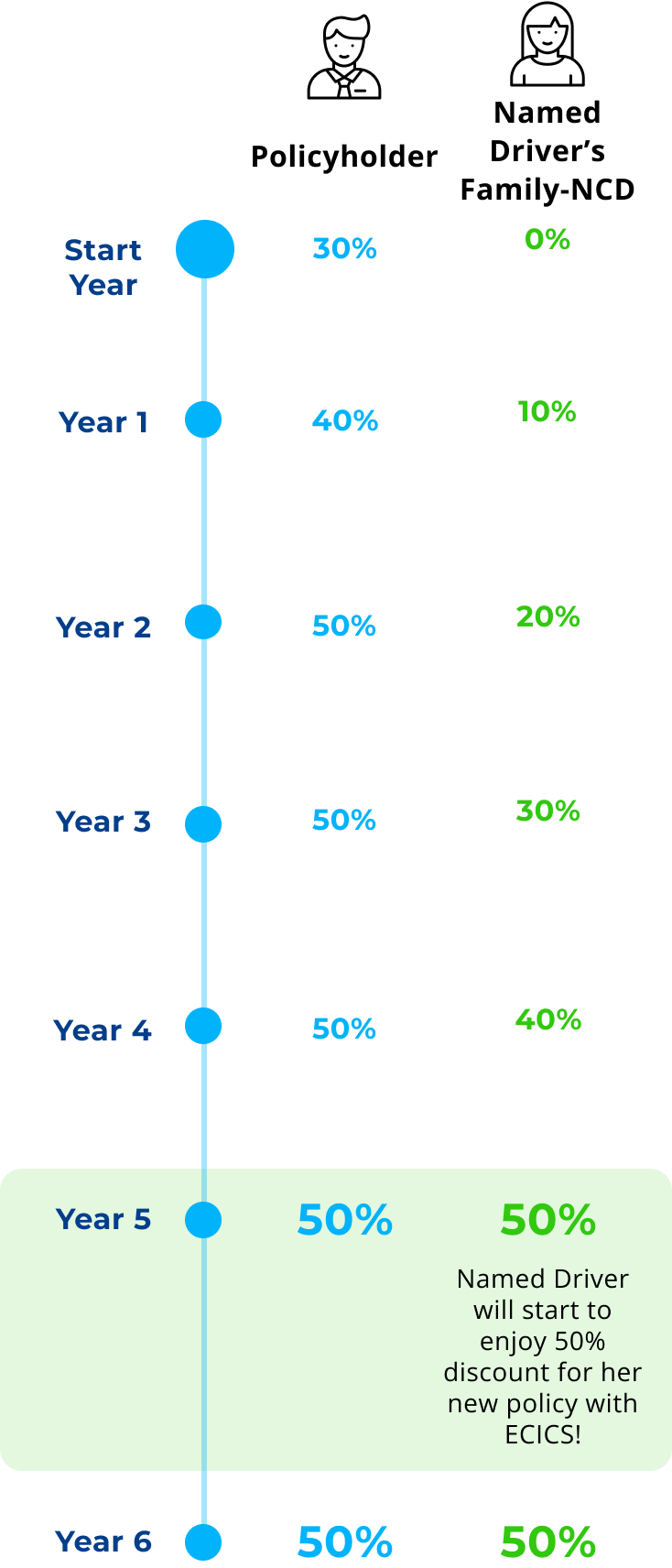

Yes, so long as the driver has a valid driving license and fulfils our underwriting criteria as named driver, you can purchase this plan and add them as a named driver in the Comprehensive Family NCD Builder Plan.

Unnamed Driver refers to someone who is not named under a private car policy.

Most insurers in Singapore will allow you to keep your NCD should there be a break in vehicle ownership for up to 24 months. Some insurers set the timeframe at 12 months. You should contact your insurer for details.