Enjoy a first-of-its-kind reward — receive Tesla fractional shares when you insure your Tesla with ECICS.

This exclusive benefit is made possible through our partnership with Phillip Securities Pte Ltd, a trusted name in investments.

Get comprehensive protection for your electric vehicle — including roadside assistance, accident repairs, and windscreen claims.

Transfer your NCD from other insurers and enjoy peace of mind with our round-the-clock claims support.

Discount is automatically applied. Not stackable with other promos. Click here to see Terms and conditions

(if you don’t have one)

(if you don’t have one)

Yes, the following occupations or activities are excluded: - Pilots, aircrew or any occupation involving aviation activities - Full-time military personnel - Police force personnel - Fire fighters - Construction / unskilled workers - Ship crew or workers on board vessels, oil and gas rig workers, offshore workers, stevedores, shipbreakers - Welding - Professional sports teams - Work involving height (exceeding 30 feet above ground or floor level) and/or works underground and/or travel beyond normal speed on land and/or handling of hazardous chemical / electricity - Use of Woodworking tools and machineries - Professional divers and jockeys - Crane Operators

Contact us at +65 6206 5588 (Mon - Fri excluding Public Holiday, 8:30am - 6:00pm) or write to us at customerservice@ecics.com.sg.

Yes, if you change your mind after the policy is issued, please write to us within 14 days from the date of receipt of the policy. We will refund you in full subject to no claims made under the policy.

We have 5 standard plans tailor-made for different industries: Office, Retail, Service, F&B and Light Industrial.

Machinery All Risks covers accidental loss of or damage to your machinery and equipment from any cause unless it’s specifically listed as an exclusion.

It is only covered under Hospital & Surgical Expenses if the FDW had been under your employment for more than 12 months.

Enhanced MaidAssure is a comprehensive insurance plan for your Foreign Domestic Worker (FDW) that covers the following benefits:- Accidental Death or Permanent Disablement,- Hospital & Surgical Expenses,- Replacement/Re-hiring Expenses,- Wages & Levy Reimbursement,- Repatriation Expenses,- Insurance bond guarantee.For more information, please refer to the policy wording. Alternatively, feel free to call us at +65 6206 5588, WhatsApp us at +65 8956 5588, or email us at customerservice@ecics.com.sg.

You will need to cancel her work permit to stop your levy and ensure that you keep a copy of her travel ticket or departure itinerary as proof. MOM will proceed to discharge the Security Bond after verifying that your FDW has left and did not re-enter Singapore. Upon discharge, you may proceed to request for policy cancellation.

• Outpatient Medical Expenses (For Accident) cover medical bills for outpatient treatments that arise solely from Accident. For example, your FDW accidentally scalds her hand while cooking and requires dressing for the burn.• Hospital & Surgical Expenses cover inpatient medical bills for treatments related to both accidents and illnesses.

No, you do not need to pay $5,000 upfront to MOM as we act as a guarantor by issuing a Letter of Guarantee to MOM on your behalf. However, if you or your FDW breaches any of MOM’s rules or conditions, MOM may forfeit the bond and demand for payment from ECICS. In such cases, we will seek recovery of the amount from you.

Our policy covers you when you ride your motorcycle in West Malaysia, the Republic of Singapore and that part of Thailand within 80.5km of the border between Thailand and West Malaysia.

A No Claim Discount Protector protects your NCD on renewal and allows you to make a claim under your policy without affecting your NCD. Without it, your NCD will be reduced should a claim be made under your policy.

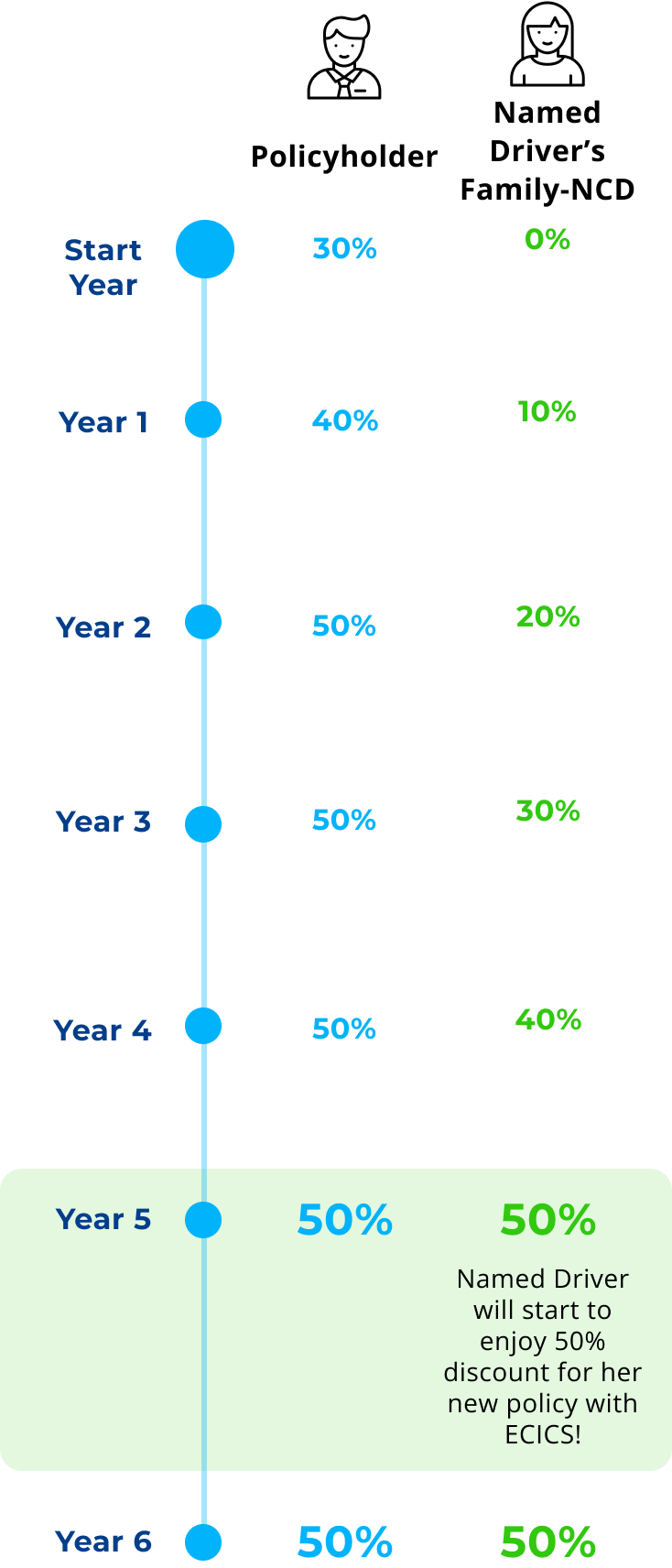

In the event that he utilise his earned Family-NCD to buy a new policy with us, he can still remain in the Family NCD policy as a named driver but he will not earn another Family-NCD. The Family-NCD can only be used once per policy per named driver.

The policy that experiences the accident claim will have the entire group of Family NCD members' (named drivers) Family-NCD reduced according to the GIA NCD framework (https://gia.org.sg/). We believe that promoting safe driving is a family affair. However, the other policy with us will not be affected, all earned Family-NCDs in that policy will remain intact.

A No-Claim Discount (‘NCD’) is an entitlement given to you if no claim has been made under your policy for a year or more with the current/existing insurer. It reduces the premium you have to pay for the following year. This is your insurer's way of recognising and rewarding you for having been a careful driver. There is a standard followed by all insurers in setting the NCD, depending on your type of vehicle (private, commercial or motorcycle) and the period of insurance with no claim. The following table shows how the NCD is set by all insurers across the industry. Private Car Period of insurance with no claim Discount on renewal 1 year 10% 2 years 20% 3 years 30% 4 years 40% 5 years or longer 50% Motorcycle/Commercial Vehicle Period of insurance with no claim Discount on renewal 1 year 10% 2 years 15% 3 years or longer 20%

If you sell your private car, you may inform us to cancel your policy. You can submit the request at customerservice@ecics.com.sg or call our mainline at +65 6206 5588 (Mon - Fri excluding Public Holiday, 8:30am - 6:00pm). Your Private Car policy refund is calculated according to the cancellation clause in your policy wording subject to no claims made against your policy.