Enjoy a first-of-its-kind reward — receive Tesla fractional shares when you insure your Tesla with ECICS.

This exclusive benefit is made possible through our partnership with Phillip Securities Pte Ltd, a trusted name in investments.

Get comprehensive protection for your electric vehicle — including roadside assistance, accident repairs, and windscreen claims.

Transfer your NCD from other insurers and enjoy peace of mind with our round-the-clock claims support.

Discount is automatically applied. Not stackable with other promos. Click here to see Terms and conditions

(if you don’t have one)

(if you don’t have one)

Typical exclusions include but is not limited to: - Injury to your own employees. - Contractual liabilities. - Damage to your own property.

No, each ECICS Motor Excess Protector Insurance Policy is meant to cover 1 vehicle at any one point in time. At the point of policy inception, you need to declare your vehicle registration number.

The deductible helps to prevent frequent claims and encourages responsible use of the policy. It also keeps the overall premium more affordable for all policyholders.

ECICS Home Contents Insurance covers the personal belongings you own within the residential premises you’re renting. It also extends to cover your legal liability as a tenant for any loss or damage caused to the rented property.

Yes, you may own more than 1 Motor Excess Protector insurance policy provided that each Motor Excess Protector insurance policy covers 1 unique vehicle registration number.

No. The Security Bond is included in our Enhanced MaidAssure along with MOM’s minimum medical and personal accident insurance as a package. We do not offer just the Security Bond.

The eligibility criteria states that the insured FDW must be between 23 and 60 years old at the time of application. This means that individuals outside of this age range may not qualify for coverage under the insurance policy.

A Security Bond is a commitment to reimburse the government if either you or your FDW violates or fail to adhere to the terms and conditions of the work permit. This bond typically takes the form of a banker's or insurer's guarantee. For each FDW you employ (excluding Malaysian helpers), you are required to purchase a $5,000 security bond.

We accept payment via Visa/Master Retail Debit or Credit Card online.

MOM will issue the discharge letter 1 week after the FDW has left Singapore. Please provide us with a copy of the discharge letter to proceed with your cancellation.Please note that the effective date of insurance cancellation will be determined based on the discharge date from MOM, not the date when the work permit is cancelled.

All riders need to be named in the policy. Unnamed riders are not covered.

Yes, it is illegal to use a vehicle in Singapore without a valid insurance cover. At a minimum, you must have third-party insurance, which covers injury or damage caused to other people and their property.

Yes, ECICS motorcycle insurance policy comes with complimentary No Claim Discount Protector. It is free for our customers as long as you have NCD 10% and above.

We have 3 plans to suit your needs. The Comprehensive plan covers loss or damage to your motorcycle, as well as third party liability for bodily injury and property damage.

We do not cover usage for food, parcel or other delivery services.

Claim directly against the Third Party who is liable for the accident. You can bring your damaged car / motorcycle to any of our Authorised Workshops or your own preferred workshop who can assist you to file the Third Party claim; orClaim Own Damage claim under your policy if you have purchased a Comprehensive coverage. You will need to pay necessary Policy Excess (if any). The workshop will then assist you to recover against the Third Party’s insurer for the Excess paid.

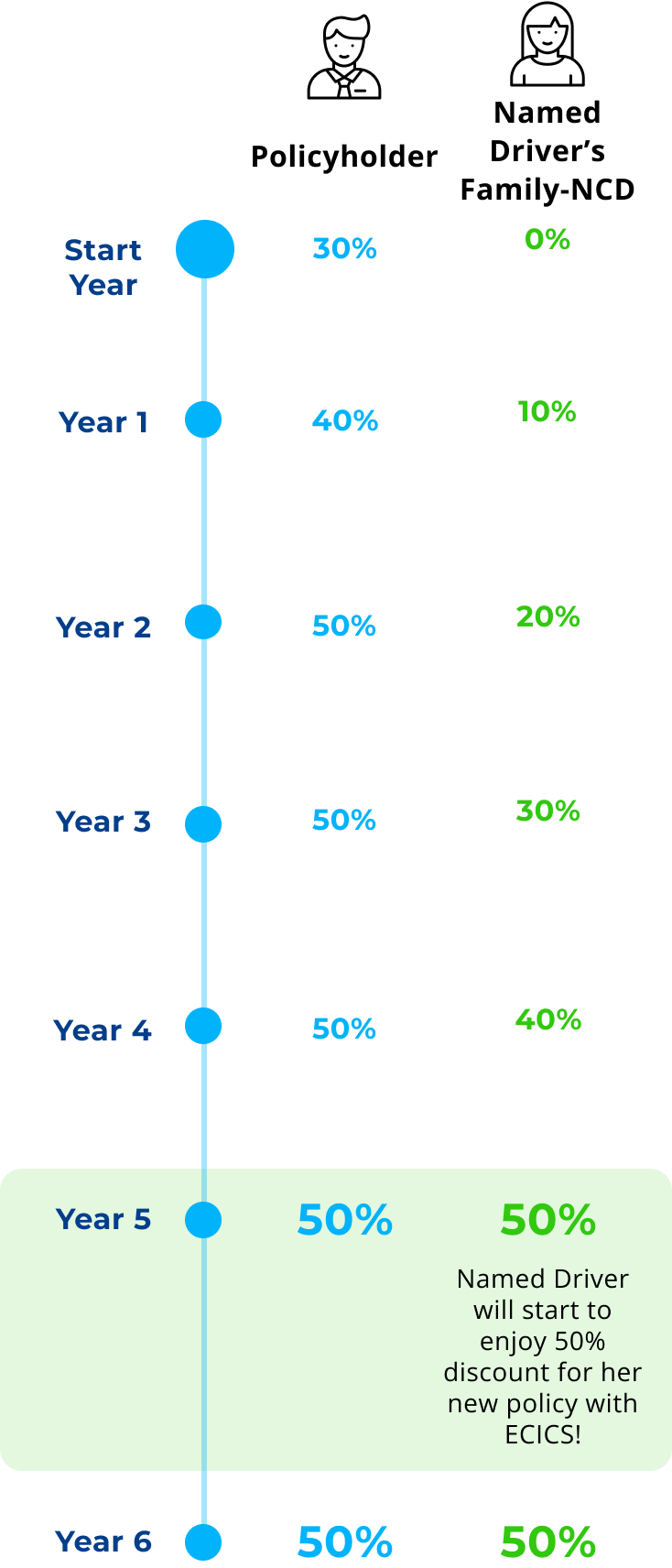

The premium of your car insurance policy is calculated based on the profiles of all the declared drivers including the named driver(s). Depending on the risk profiles of the drivers, the premium may remain the same, increase or decrease.

If there is a claim made under the policy, your NCD will be reduced as follows. Private Car Current NCD NCD after 1 Claim 50% 20% 40% 10% 30% and under 0% Motorcycle/Commercial Vehicle Current NCD NCD after 1 Claim 20%/15%/10% 0%