Enjoy 10% off charging at all public Charge+ locations for 3 months.

Living in a condo with Charge+ chargers? Get 1 month of Nano-tier access for free.

Includes comprehensive protection, windscreen claims, and reliable claims support.

If you insure your Tesla with ECICS, you also receive complimentary Tesla fractional shares—stackable with Charge+ benefits. Want to find out more? Click here

(same mobile number linked)

Terms and conditions apply. Discount is automatically applied. Not stackable with other promos.

ECICS will be transmitting the details of your Private Car Policy to LTA upon successful enrolment within 3 business days. Please contact our mainline if you require support to urgently submit to LTA for online road tax renewals. Alternative, you can proceed to LTA office with the Certificate of Insurance to physically renewal your road tax at LTA office. Our mainline number is +65 6206 5588 (Mon - Fri excluding Public Holiday, 8:30am - 6:00pm).

To implement for MI policies, renewals or extensions with start date effective from:1 July 2023 (Stage 1)• Introduction of a co-payment element* for employers and insurers for amounts above $15,000, up to an annual claim limit of at least $60,0001 July 2025 (Stage 2)• Standardisation of allowable exclusion clauses• Introduction of age-differentiated premiums for those aged 50 and below, and those aged above 50• Requirement for insurers to reimburse hospitals directly upon the admissibility of the claimPlease visit MOM's website here for more information on the MI enhancements.

Here's how you can determine the effective date based on each situation:For New FDW:The policy's effective date should be the date your FDW arrives in Singapore. This ensures that insurance coverage begins when the FDW starts her employment duties upon arrival in the country.For Transferred FDW:The policy's effective date should be the day you wish to apply for the issuance of her work permit at MOM. This ensures that insurance coverage is in place when the FDW's work permit is processed and approved for transfer to your employment.For Renewal FDW:The policy's effective date should be one day after the current work permit's expiry date. This ensures that insurance coverage seamlessly continues without any gaps when renewing the FDW's work permit for continued employment.

The deductible helps to prevent frequent claims and encourages responsible use of the policy. It also keeps the overall premium more affordable for all policyholders.

Yes, the following occupations or activities are excluded: - Pilots, aircrew or any occupation involving aviation activities - Full-time military personnel - Police force personnel - Fire fighters - Construction / unskilled workers - Ship crew or workers on board vessels, oil and gas rig workers, offshore workers, stevedores, shipbreakers - Welding - Professional sports teams - Work involving height (exceeding 30 feet above ground or floor level) and/or works underground and/or travel beyond normal speed on land and/or handling of hazardous chemical / electricity - Use of Woodworking tools and machineries - Professional divers and jockeys - Crane Operators

No, you are not able to purchase the Waiver of Counter Indemnity after policy has incepted.

No, she is not covered unless she is travelling with you. We recommend purchasing a separate travel insurance for your FDW as the coverage would be more comprehensive for overseas situations where medical and evacuation costs are expected to be much higher.

To implement for MI policies, renewals or extensions with start date effective from:1 July 2023 (Stage 1)• Introduction of a co-payment element* for employers and insurers for amounts above $15,000, up to an annual claim limit of at least $60,0001 July 2025 (Stage 2)• Standardisation of allowable exclusion clauses• Introduction of age-differentiated premiums for those aged 50 and below, and those aged above 50• Requirement for insurers to reimburse hospitals directly upon the admissibility of the claimPlease visit MOM's website here for more information on the MI enhancements.

Yes, the policy will need to be cancelled, and a replacement policy issued.

The coverage period for our Enhanced MaidAssure is 14 months or 26 months with the additional 2 months included as mandated by the Ministry of Manpower (MOM) in case the FDW overstays in Singapore after her work permit expires.

All riders need to be named in the policy. Unnamed riders are not covered.

Yes, it is illegal to use a vehicle in Singapore without a valid insurance cover. At a minimum, you must have third-party insurance, which covers injury or damage caused to other people and their property.

Yes, ECICS motorcycle insurance policy comes with complimentary No Claim Discount Protector. It is free for our customers as long as you have NCD 10% and above.

We have 3 plans to suit your needs. The Comprehensive plan covers loss or damage to your motorcycle, as well as third party liability for bodily injury and property damage.

We do not cover usage for food, parcel or other delivery services.

Claim directly against the Third Party who is liable for the accident. You can bring your damaged car / motorcycle to any of our Authorised Workshops or your own preferred workshop who can assist you to file the Third Party claim; orClaim Own Damage claim under your policy if you have purchased a Comprehensive coverage. You will need to pay necessary Policy Excess (if any). The workshop will then assist you to recover against the Third Party’s insurer for the Excess paid.

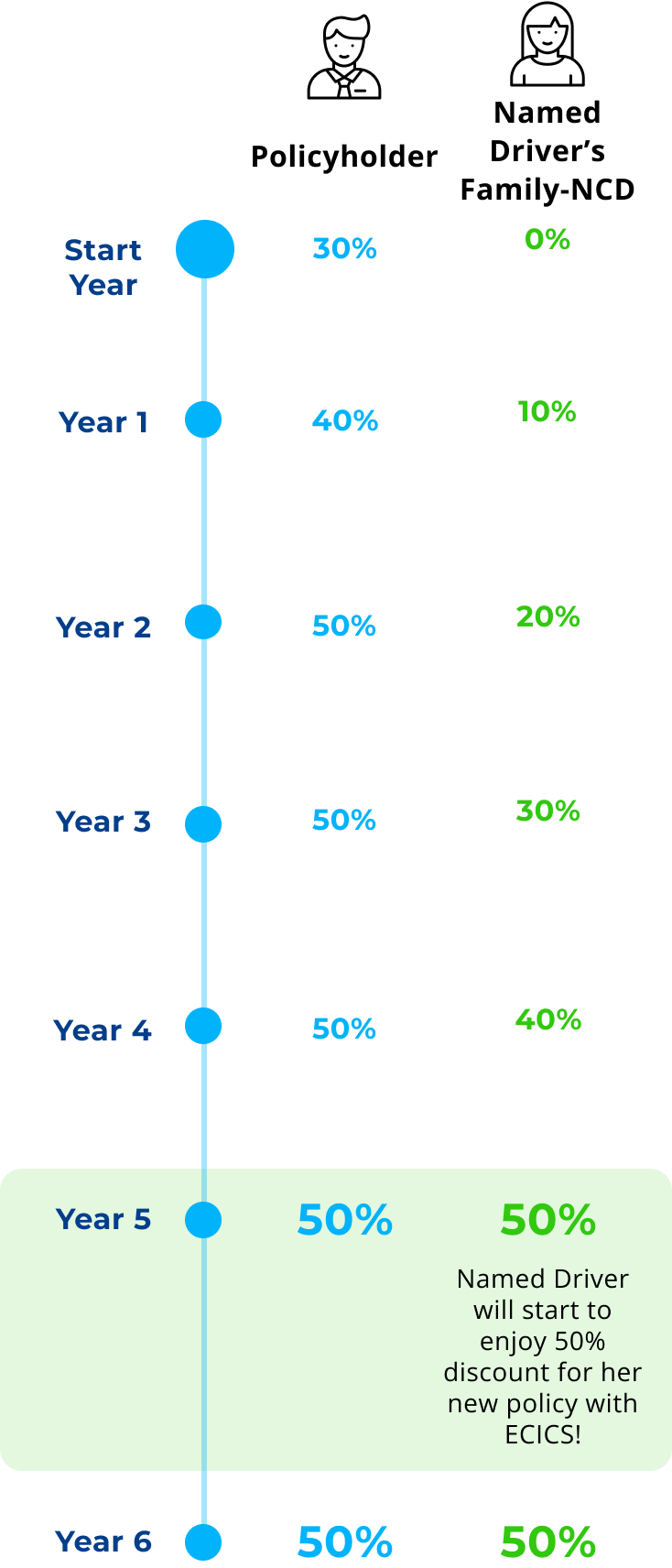

The premium of your car insurance policy is calculated based on the profiles of all the declared drivers including the named driver(s). Depending on the risk profiles of the drivers, the premium may remain the same, increase or decrease.

If there is a claim made under the policy, your NCD will be reduced as follows. Private Car Current NCD NCD after 1 Claim 50% 20% 40% 10% 30% and under 0% Motorcycle/Commercial Vehicle Current NCD NCD after 1 Claim 20%/15%/10% 0%